From the Alternative Investment Management Association (AIMA)*

Among the findings in AIMA’s paper “In Concert – exploring the alignment of interests between hedge fund managers and investors” :

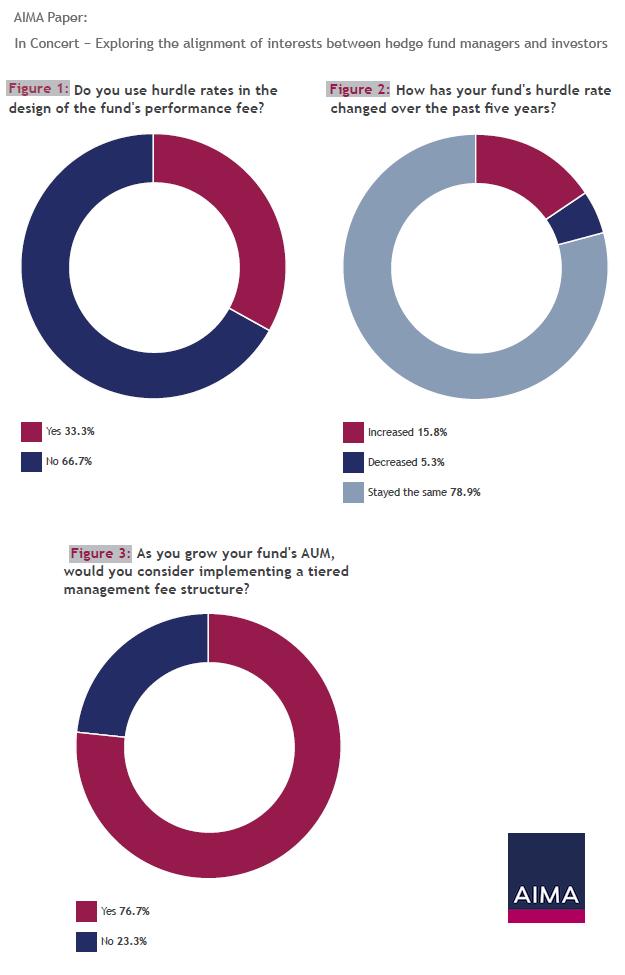

- One-in-three managers now charge performance fees above a hurdle rate, such as a fixed percentage or an index-based benchmark

- Three-quarters (77%) of managers offer or are considering offering a sliding fee scale, whereby management fees are reduced as the fund raises assets above particular thresholds

- Although not widespread, more fund managers are offering claw backs, whereby a share of past performance fees are returned to investors during loss-making periods

- Longer lock-ups in exchange for lower fees and other beneficial terms are increasingly common

- Nearly two-thirds (61%) of managers consider that having a significant personal investment in the fund is the single most important method for aligning interest with their investors

- Around half of managers (48%) offer or are considering offering co-investment to their investors, via either a particular investment opportunity or jointly-managed fund

*from a new survey by the Alternative Investment Management Association (AIMA), the global representative for alternative asset managers. The survey of 120 alternative investment fund management firms has been sponsored by RSM, a provider of audit, tax and consulting services focused on the middle market.