By Hedge Fund Insight staff

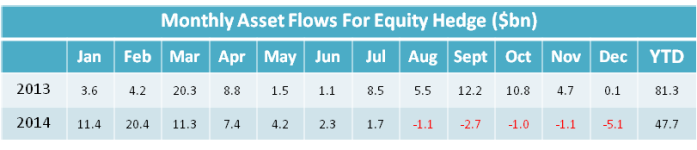

From January 2013 to July 2014 equity hedge funds was the only strategy group to receive net inflows each month, according to the data tracked by Eurekahedge. In that period the flows into fixed income hedge funds were very nearly as consistently positive, but the scale of net subscriptions was much larger into equity hedge funds. For example, twice as much new capital was committed to equity hedge funds in 2013 ($81.3bn v $40.4bn).

Long/short equities have recorded the bulk of the asset inflows into the industry, accounting for 74.4% of net asset flows into the industry since 2013, according to Eurekahedge. Indeed, total assets in long/short equities currently stand at US$737.1 billion, just 2.5% off their December 2007 historic high of US$756 billion.

But net flows for the last five months of 2014 came in negative at US$11.1 billion despite strong performance-based gains of US$17.4 billion over the same period. The Eurekahedge Long Short Equity Hedge Fund Index is up 3.28% as at December 2014 year-to-date, corresponding with performance-based gains of US$30.9 billion over this period.