By Vincent Sarullo, Tower Fund Services, and Hedge Fund Insight staff

AUM is the lifeblood of the investment management business and competition for assets is fierce. To grow AUM can be the single most difficult aspect of running a hedge fund business. Most small hedge funds are operated by former portfolio managers, traders or research analysts, who know how to manage money.

A true test will be diverting enough time towards marketing activities without sacrificing any investment performance. Raising capital should be a non-stop, full-time process, which requires devoting patience, time and commitment into crafting comprehensive marketing strategies. All too often we see managers feverishly scrambling to get their initial investors in and once they start investing, the capital raising efforts come to a grinding halt.

Time is valuable, spend it wisely. Though it has not been quantified, there is a correlation of reduction in performance relative to the increase in manager activities not directly related to investment decisions.

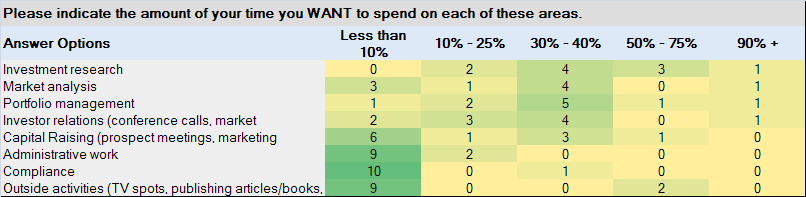

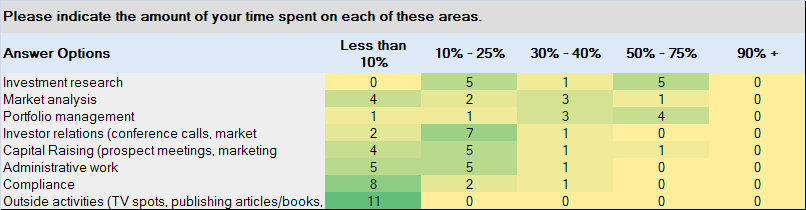

Based on a recent Tower survey of emerging managers that have been in business for under 5 years, areas that time is dedicated is fairly consistent with 50%-75% being dedicated to Investment Research/Market Research/Portfolio Management; 10%-25% being current investor relations; 0% – 25% spent on capital raising; and a small amount of time dedicated to other firm matters and outside industry related events. The survey data tables are shown below, with the number of respondents given in each cell.

The heavy response rate in the bottom half of column 1 above reflects the DESIRE to have to spend a minimum of time resource by managers on non-investment matters. The reality of time spent is shown in the table below.

There are two significant zones of different frequency of response between tables 1 and table 2 above. In reality (table 2) managers spend less time on investment matters (column 3, 30-40% upper half) and more time on non-investment matters (column 2, 10-25% lower half) than they WANT (table 1).

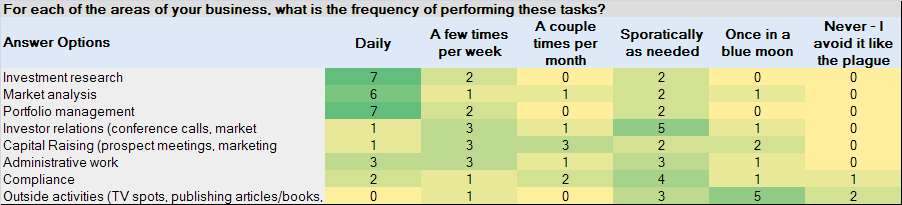

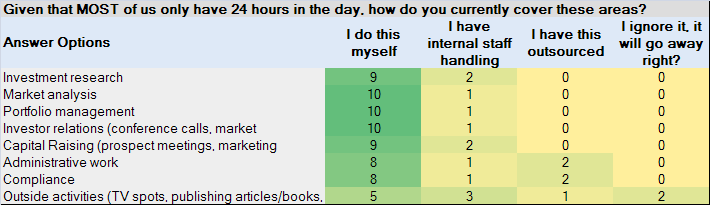

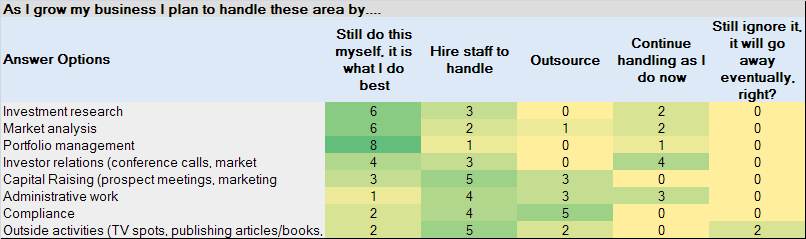

The rest of the survey deals with how often managers deal with each area of activity (table 3), how they cover these activities now (table 4), and finally what methods will used to resource these activities as the firms grow (table 5), indicating planned strategic choices given AUM growth.

Investors and prospects want their fund managers to focus on making money. However, they want to hear from the managers and not just via getting capital statements. How do you balance the time? Some guidance is at hand.

Tower Fund Services this week released their second video in a series designed to guide hedge fund managers through the common challenges faced by the emerging fund manager. This video provides some simple steps and insights into the capital raising process for new hedge funds.

About Tower Fund Services: Tower Fund Services is an independent third party administrator that provides an outsourced solution for alternative investment managers. Tower’s core business focus is start-up and emerging managers that are looking to grow their hedge, private equity, venture capital, real estate, and tax lien funds. We enable our clients to focus on their core business; investing, while having a high quality infrastructure support group behind them.