By Hedge Fund Insight staff, based on the work of Javier Paz of Aite Group

Hedge Fund Insight bought into the prospects for Blockchain Technology in finance some time ago (see related articles below). Amongst the first areas to be impacted in asset management is securities settlements. The following article is based on three Impact Reports from Aite Group’s Wealth Management practice.

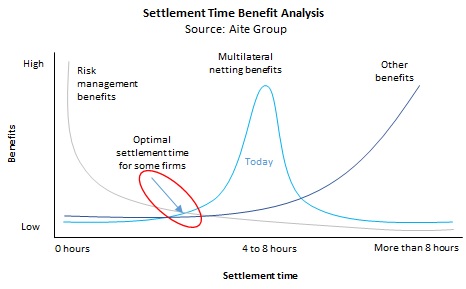

Distributed ledger technology (DLT) is the catalyst triggering change, but in what part of the settlement equation does blockchain technology make sense? And what is not yet operationally ready? Research from Aite Group and reflected in the graphic below infers that future processes will look to settle in sub-4 hours.

There are serious issues to be addressed in order to make progress. In settlement processes there are competing operational models, such as multilateral netting settlement versus real-time settlement.

An issue of adoption is the interoperability between legacy and DLT networks and among DLT platforms.

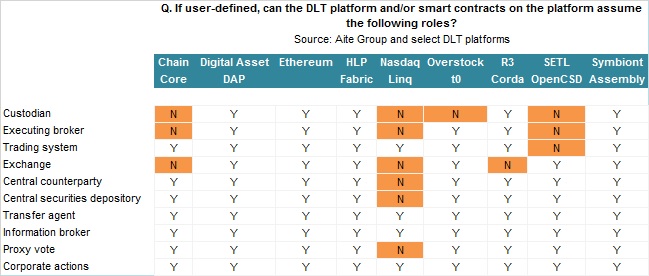

The early movers: The Australian Securities Exchange (ASX) and Nasdaq and Overstock.com have blockchain deployments in the post-trade space. Aite Group has surveyed 26 senior executives to establish their views of DLT in the securities settlement function. The capabilities per platform are shown in the table below.

It will not be a surprise that centralised capabilities are well covered already by DLT platforms – central counterparty and centralised securities depository roles can be implemented on all the platforms assessed. An area that distributed ledger technology will have a big impact on is corporate actions. Whilst this is important in asset management it is particularly important in certain hedge fund strategies such as event-driven and fixed income strategies with significant coupons.

Winners? By Company or By Technology?

More than US$300 million has gone into supporting DLT efforts in the settlement space in the past two years. Following in the footsteps of ASX and NASDAQ, dozens of distributed-ledger-technology capital-markets deployments will be ready to move in 2017. Regulators as well as business leaders confront a twin challenge: grasping this new technology and passing new rules based on partially understood truths, pitfalls, and nuances. Whilst the blockchain platform vendors that are chosen by corporations or capital markets firms stand to make today’s emerging chains run as smoothly as TCP/IP does for the internet the vendors cannot all equally benefit. The winners among the 10 chaintech platforms (Axoni AxCore, Chain Core, Digital Asset platform, Ethereum, Hyperledger’s Fabric, Nasdaq Linq, Overstock.com’s t0, R3’s Corda, SETL’s OpenCSD, and Symbiont’s Assembly) need to be near the top of the pack to survive what Aite Group calls “the inevitable cuts.”

Ahead there are strategic implementation decisions to be made by financial regulators, chaintech proponents, and incumbent settlement firms. For example on the systems side vendors must decide whether to acquire or develop blockchain technology now. Whilst the clients of these vendors are not requiring or demanding the use of distributed ledger technology at this point, they will be in the course of time. and that means that the vendors have to make decisions shortly on which technology to adopt.

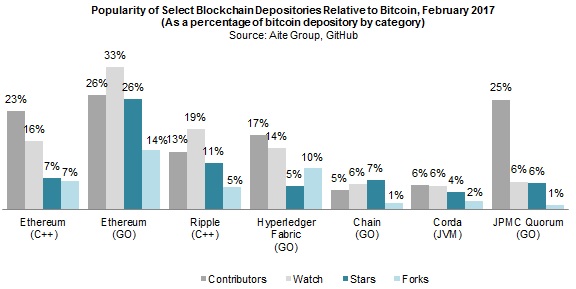

In terms of Blockchain Depositories decisions are already being made (horses being backed, if you like). This graphic shows the extent of commitment by category (Contributor/Watch/Star/Fork, defined below) for selected platform/language combinations.

Watch is the number of people who have added the project to their watchlist. This gives them updates about the project and is an indication of the number of people who care about changes to the code, rather than just use the project.

Star is the number of people who find a project interesting and want to indicate that. It also adds a bookmark for favorite projects.

Fork is the number of people who have cloned the repository with the intention of adding their own changes to it. Often times such people don’t actually contribute but it shows a level of interest in contributing.

To demonstrate that Blockchain Technology is not futureware or vaporware it is useful to cite the example of administrative behemoth Northern Trust (US$6.7 trillion in assets under custody). Northern Trust carries out the administrative functions for a multitude of private equity funds. These have unique life cycles, complicated structures, and documents and “artifacts” exchanged by parties using unique rules and permissions. The manual nature of this administrative work imposes time delays and a variety of costs to all parties. The solution that Northern Trust and IBM jointly designed and built is a blockchain solution, using as its base Hyperledger’s Fabric platform and IBM’s Bluemix secure cloud infrastructure. While custom-built to serve the needs of a particular asset manager client, Geneva-based Unigestion (US$20 billion in AUM), this Northern Trust blockchain implementation will serve additional private equity clients over time. Northern Trust will control who is permissioned and for what access. Unlike public equity, private equity can be held by one or very few investors, and the investment is idiosyncratic rather than of a type. Historically it has been difficult to integrate private equity into systems that record and monitor multi-asset class portfolios.

About Aite Group: Aite Group partners with participants in the international financial services marketplace, leveraging our analysts’ industry experience to challenge, to advise, and to catalyze growth through independent market research and timely consulting. Attuned to the needs and strengths of our clients, Aite Group builds bridges, brokers insight, and offers actionable advice that companies rely on to build their relationships and grow their businesses.

related articles on HF Insight:

Blockchain & the Funds Industry (Oct 2016)

Bitcoin Is Coming (or at least Blockchain Technology is) (Dec 2015)