From Thomson Reuters

Global Deals Intelligence

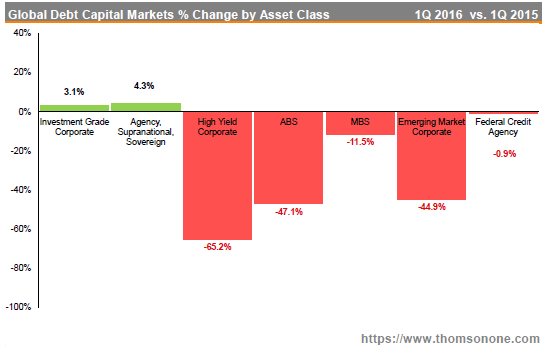

GLOBAL DEBT CAPITAL MARKETS ACTIVITY FALLS 8%

Overall global debt capital markets activity totalled US$1.6 trillion during the first quarter of 2016, an 8% decline compared to the first quarter of 2015 and the slowest opening period for global debt capital markets activity since 2008.

First quarter global debt activity increased 41% compared to the fourth quarter of 2015, marking the largest percentage gain for consecutive quarters since the first quarter of 2012 when proceeds increased 77% compared to the fourth quarter of 2011.

US INVESTMENT GRADE CORPORATE DEBT BREAKS FIRST QUARTER RECORD

Powered by a number of multi-billion dollar acquisition-related financings, high grade corporate debt offerings targeted to the US marketplace totaled US$352.1 billion during the first quarter of 2016, an increase of 1% compared to a year ago and the fifth consecutive first quarter to break a standing record for the asset class.

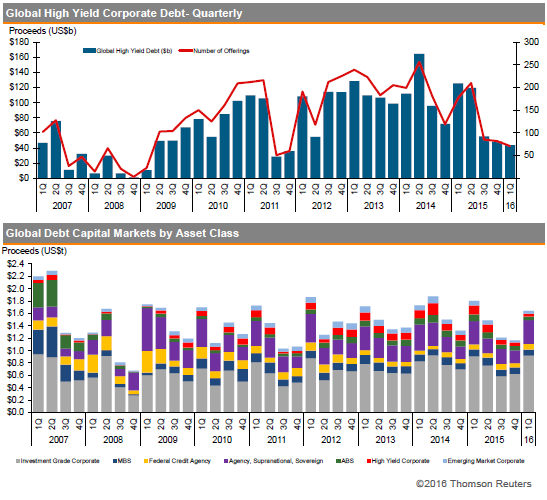

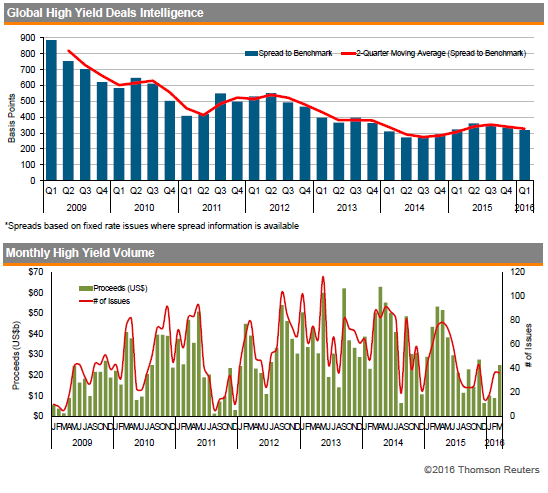

GLOBAL HIGH YIELD VOLUME DOWN 65%

The volume of global high yield corporate debt reached US$43.6 billion during the first quarter of 2016, a 65% decrease compared to the first quarter of 2015 and the slowest quarter for global high yield issuance since the fourth quarter of 2011.

First quarter issuance fell 10% compared to the fourth quarter of last year, marking the third consecutive decline for high yield corporate debt, by proceeds and number of issues.

TELECOM OFFERINGS LEAD GAINERS; ENERGY & HEALTHCARE FALL MORE THAN 50%

Debt capital markets activity in the Telecommunications sector totaled US$34.1billion during the first quarter of 2016, registering an industry-leading increase of 32% compared to year-ago levels and an average deal size of nearly US$1.1 billion.

Healthcare and Energy & Power activity saw the steepest year-over-year declines, registering decreases of 58% and 50%, respectively.

US Deals Intelligence

US Investment Grade debt increased 1% compared to the first quarter of 2015. The US$352.1 billion raised from 212 issues represented the fifth consecutive increase for the opening quarter. First quarter volume was boosted by three transactions with a principal amount over US$10 billion, including the US$46 billion Anheuser-Busch deal, which ranked as the second largest bond issue on record. The proceeds were used to fund the US$121 billion acquisition of SABMiller PLC.

US High Yield corporate debt volume in the first quarter of 2016 decreased 62.3% from the proceeds raised in the first quarter a year ago. The US$32.9 billion raised represented the third lowest opening quarterly volume since 2007.

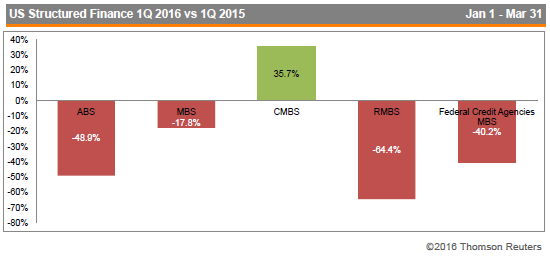

US ABS issuance decreased significantly from first quarter 2015, declining 48.9% to US$42.8 billion. The proceeds from CMBS increased 35.7% to US$40.6 billion from a year ago.

European Deals Intelligence

International Bond volumes were down 14.2% from the equivalent period in 2015. Overall proceeds raised in the market of US$1 trillion represented the lowest first quarter since 2009.

High profile deals priced by EMEA issuers in the first quarter included Belgian headquartered Anheuser Busch Inbev’s US$46 billion bond towards its acquisition of SAB Miller, which was the second largest deal on record (behind Verizon’s US$49 billion in 2013). The seven-tranche transaction was led by a bookrunner group which consisted of eighteen banks. The same issuer followed up this deal with a further €13.3 billion six-tranche offering in March, which ranked as the largest Euro corporate deal on record. United Kingdom telecoms provider Vodafone came to market in February with a €6 billion deal which raised capital for general corporate purposes.