By Josh Galper, Managing Principal, Finadium

With foundational changes instituted since 2008, the imperative that drove investors to demand greater transparency from their fund managers also prompted custodians and prime brokers to alter their service offerings for long/short funds. Long/short funds now have a variety of custody and leverage service models to choose from including Prime Custody, Enhanced Custody and other prime brokerage/custody hybrids.

With foundational changes instituted since 2008, the imperative that drove investors to demand greater transparency from their fund managers also prompted custodians and prime brokers to alter their service offerings for long/short funds. Long/short funds now have a variety of custody and leverage service models to choose from including Prime Custody, Enhanced Custody and other prime brokerage/custody hybrids.

This article is a discussion of important points for long/short funds to consider in evaluating the success of their custodial relationships and in selecting a new custodian. The article focuses on reporting, operational considerations and the cost of leverage as three main criteria for building a successful Service Level Agreement.

Why Long/Short Funds Need a Custodian

Key Points:

- Long/short funds have adopted regulated structures and have signed up with custodians to provide transparency and operational comfort to both retail and institutional investors.

- Both the number and assets under management of Alternative UCITS and ’40 Act mutual funds rose from 2013 to 2014.

- Custodians can facilitate new requirements for regulatory reporting around the world coming from FATCA, AIFMD, Form PF and other rules.

Long/short funds come in a variety of structures, including US ’40 Act Liquid Alternatives (mutual funds), Alternative UCITS funds, hedge funds and separately managed accounts. While the regulatory wrapper around these funds may vary, their core needs are very similar: funds need accurate valuations, reporting and access to the leverage that is critical for their trading strategies. Many of the newer funds in this category are targeted towards retail investors, which adds an extra level of regulatory and client scrutiny to ensure that investors are treated fairly. Retail investors can now reach long/short funds more quickly than ever and can leave just as fast. While US ’40 Act mutual funds and UCITS funds must have a custodian, other long/short accounts have opted to sign up with a custodian for trust, convenience or pricing.

Custodian banks have responded to the sharp growth in long/short funds by offering specialized custody services including Prime Custody. Today’s global custodians are key providers of core custody and value-added services including striking the daily Net Asset Value (NAV) of a fund and providing access to securities borrows and leverage within their own account. While not all custodians have fully embraced the business of prime brokerage, they now offer enough overlapping services that a fund requiring some prime brokerage can elect to work with a custodian instead.

Hiring a custodian solves multiple problems for long/short funds even when not mandated by regulation. Investors tend to dislike the lack of transparency that accompanies hedge funds. They may also have concerns about the operational integrity and controls at each fund. When hedge fund clients ask to move into a separately managed account or a regulated structure, custodians can provide investors with a daily view into their holdings, risk profile and leverage. Custodians also provide a recognized and institutionalized level of operational efficiency for their clients. These important developments have contributed to increasing high net worth investors’ comfort with Liquid Alternatives and the growth of custodian services for long/short funds in general.

A Proliferation of Long/Short Funds

In this article we define long/short as an investment strategy that involves taking long positions in assets that are expected to increase in value and short positions in assets that are expected to decrease in value. We will use equities as the example for this report. A key objective of many long/short funds is to minimize exposure to the market and to generate profit from a change in the spread between two stocks. The total return from long/short funds is a combination of the return from market exposure (beta) plus any value added from stock picking or market timing (alpha). In long/short portfolios, the short positions can either be taken physically, which entails borrowing actual securities, or synthetically using swaps. The long portion can also be taken physically or synthetically and may include leverage.

While institutional investors have used long/short strategies for many years, they are also becoming increasingly popular among individual investors. This is helping to fuel the overall growth in regulated long/short fund assets. As the Liquid Alternatives marketplace becomes increasingly competitive, it is expected that individual investor fund flows will continue.

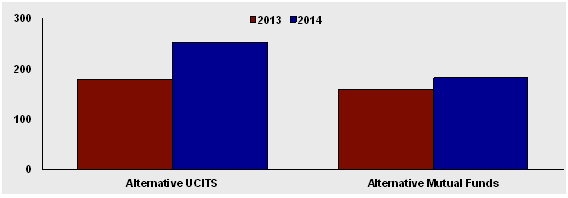

Data from Q4 2014 show a 41% increase from Q4 2013 in the assets under management of Alternative UCITS funds, ending the year at EUR 224 billion (US$253 billion), according to Alceda (see Exhibit 1). US Liquid Alternative mutual funds grew more slowly at 16%, ending 2014 at US$183 billion, according to Morningstar.

Exhibit 1: AUM of Alternative UCITS and Liquid Alternative ’40 Act Mutual Funds (U$ billions)

Sources: Alceda, Morningstar

Sources: Alceda, Morningstar

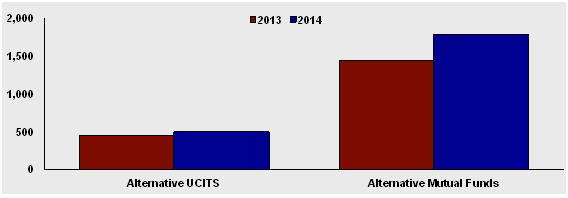

The number of alternative funds is also increasing. Alceda saw a 12% rise in the number of Alternative UCITS funds while Morningstar reported a 24% increase in Liquid Alternative mutual funds (see Exhibit 2). While returns may vary, the number of new funds launching indicates that the regulated, liquid long/short market remains open to new entrants and experimentation.

Exhibit 2: Number of Alternative UCITS and Liquid Alternative ’40 Act Mutual Funds

Sources: Alceda, Morningstar

Sources: Alceda, Morningstar

A new category of Alternative ETFs is growing in importance although defining this strategy can get confusing. Some ETFs are classified as Managed ETFs that use options, which is leverage, or may be inverse. Others seek to mimic a hedge fund or basket of hedge fund returns. Morningstar tracks 143 funds in its Managed ETF category that are anything other than long-only structures. ETF Database tracks 31 funds that are “alternative non-lev

eraged ETFs” and one “alternative leveraged ETF.” Together, these 32 funds have a relatively small US$1.9 billion in assets under management.

Operational Challenges for Long/Short Funds

Key Points:

- Long/short funds increasingly need to provide transparency on their funding costs and offer a proof of best execution or sufficient management due diligence to investors.

- Valuations and timely reconciliations of OTC derivatives positions are chief concerns for alternative fund managers, and areas where custodians can provide solutions.

A number of structural flaws were uncovered in the immediate aftermath of the Bear Stearns and Lehman Brothers failures. Investors sought to address liquidity mismatches, transition to a more transparent investor-manager engagement model, mitigate adjacency risks, ensure better alignment of fees and terms, and create a robust culture of oversight. The growth of regulated long/short funds and separately managed accounts can be seen as one result of this process. Creating a transparent long/short fund does not happen overnight however. A primary concern is how managers will achieve downside exposure and leverage for long positions. The options are:

- Borrowing Stock (Physical): borrowing securities from a prime broker, a clearing firm or a custodian.

- Margin Financing: borrowing money from a bank or prime broker to take long positions beyond the cash availability of the fund.

- Utilization of Synthetic Exposure: trading a swap with a bank using an ISDA agreement.

- Listed Derivatives: investing in listed options or futures to go long or short.

- Self-funding: lending securities to generate cash that could in turn be used in place of margin borrowing.

Reporting on the cost of this financing is an important consideration for investors. Investors want to understand how their long/short managers verify any financing fees associated with trades and may require managers to utilize independent valuations. This encourages the notion of best execution in securities lending and financing that is a new and challenging concept, but custodians can reasonably provide that or at least something close. Proving some sort of best execution can pose additional challenges when dealing with illiquid instruments.

Reconciliations of OTC derivatives can be an operational challenge for fund managers. The frequency of reconciliations is key to both efficient collateral management and counterparty risk exposure. It became evident to many managers in the aftermath of the financial crisis that there was a lack of detailed collateral reporting to support risk and compliance monitoring. In today’s risk management environment, managers are often looking to their custodians to provide Value-at-Risk (VaR) reporting along with their standard fund accounting and reporting.

Independent valuations can be another difficulty for some funds, and is an area where custodians can lend support through their relationships with various pricing vendors. Under UCITS rules there is a requirement for daily valuations, which can be particularly difficult when the fund holds illiquid instruments or complex assets. Fund managers are constantly testing permitted tolerance levels; this requires extremely accurate fund accounting delivered in a timely fashion.

Regulators such as the Bank of England have issued requirements to reduce equity derivatives confirmation backlogs. The goal of this requirement is to increase the certainty about a financial firm’s positions, in order to be more confident of what trades they have on their books in the event of a market crash or period of extreme volatility. The Federal Reserve is monitoring the processing of OTC derivatives closely, and are working with the financial services industry to ensure that infrastructure is not only scalable and efficient, but that it also manages operational risk effectively. The need to reduce confirmation backlogs puts the responsibility back on fund managers and their designated custodians to work together. The custodian community and fund managers continue to work toward operating in a Straight-through Processing (STP) environment in order to mitigate risks. Regulators have rightfully highlighted the importance of utilization of electronic trade confirmation platforms as being fundamental to risk management.

A consistent theme of custody services for long/short managers is the complicated question of who manages any prime brokerage relationships. The mechanics of this interaction can include the long/short manager taking an active role, the custodian and prime broker managing all interactions behind the scenes, or no prime broker involvement at all if the custodian is able to provide physical or synthetic leverage on its own.

Service Level Agreements and Key Performance Indicators

Key Point:

- Fund managers typically want to create Service Level Agreements (SLAs) with their custodians, then monitor those SLAs to ensure that the services received are equal to the services offered.

Every Service Level Agreement (SLA) should be established with a set of quantifiable measures or Key Performance Indicators (KPIs) that an Investment Manager can use to gauge custodian performance. The KPIs that each firm decides to establish can vary between counterparties depending on their performance objectives and strategies of the fund. Some typical criteria that a long/short fund manager might want to capture in a SLA with their custodian include:

1) Valuation Frequency. This should include specifics on the use of outside vendors for valuations and any required independent valuations.

2) Regulatory reporting. What regulators must the custodian report to and what will they be reporting? What regulators must the fund manager report to and what level of support will the custodian provide to support the fund manager? Are there additional regulatory reporting requirements on the part of the fund manager’s clients that the custodian is able to help the fund manager fulfill? All details related to these functional requirements should be documented (recognizing that regulatory reporting requirements are constantly changing).

3) OTC Derivatives reconciliations. The frequency of reconciliations is something that all managers should agree to with their custodians.

4) Fund and Investor reporting. The frequency and format of reporting may vary depending on the fund’s objectives and risk tolerance, but it should include VaR and specifics on collateral. Lack of detailed collateral reporting is a significant operational concern for fund managers today.

5) Collateral Management. Where and when relevant to securities and collateral, margin should be delivered to the account of the counterparty, their agent or a designated third party.

- Valuation Adjustments. When a corporate action occurs, the SLA should set out how and when the collateral is to be adjusted.

- Mark to Market. Any loans and collateral should be marked to market on a daily basis and more frequently should the need arise in periods of extreme volatility.

As detailed in the December 2014 Finadium report, “Understanding the Modern Custodial Bank,” custodians who are willing to work in partnership with their asset management clients, who in turn are seeking to launch increasingly diverse funds to their client base, will be best positioned to capitalize on the growth of diverse long/short funds.[1] Fund managers themselves should be alert to the commitment of their custodians to their funds’ immediate and longer-term growth strategies.

© Copyright of this content is with Finadium LLC

About the Author

Josh Galper is Managing Principal of Finadium and runs the firm’s research and consulting advisory practice. He is a regular speaker at industry conferences and has been quoted in major mainstream and financial industry publications. He holds an MBA from the MIT Sloan School of Management. He can be reached at jgalper@finadium.com.

About Finadium LLC

Finadium is a research and consulting firm focused on securities finance and asset servicing in financial markets. Finadium research is available on a subscription basis. Finadium conducts consulting assignments on product development, marketing and strategy. For more information, please visit our website at www.finadium.com and follow us on Twitter @Finadium. Finadium also produces the web publication Securities Finance Monitor.

[1] “Understanding the Modern Custodial Bank,” Finadium, December 2014, press release available at http://www.finadium.com/site/moderncustodialbank.php.