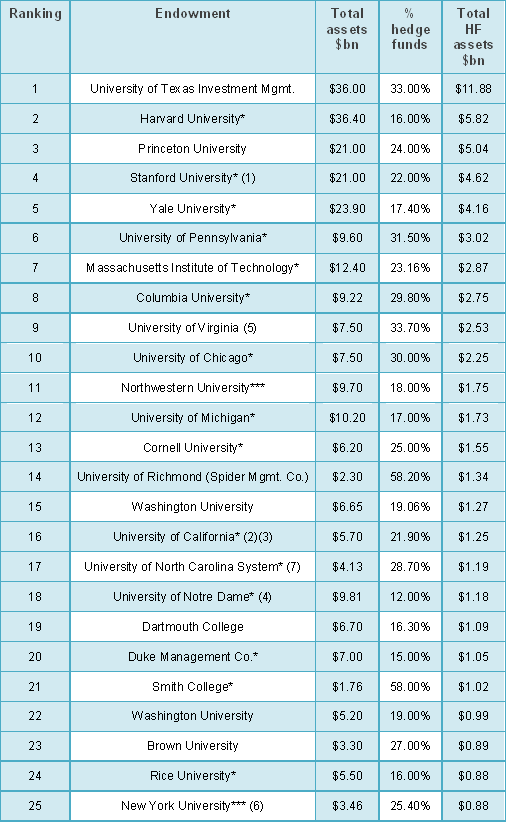

NOTE: * As of 30 June 2014 ** As of 31 December 2014 *** As of 31 August 2014 **** As of 31 March 2015, endowment only ***** E&F value as of 30 June 2014; allocations as of 30 June 2015 ****** As of 31 May 2014

(1) Assets in absolute return; does not include long/short equity, which Stanford Management Co. includes in Public Equity but does not break out. (2) Asset total for all 10 schools in the UC system (3) Hedge fund weighted average for all 10 schools in the UC system (4) Marketable alternatives assets (5) Includes L/S equity and marketable alternatives and credit (6) Opportunistic and credit only; does not include long/short equity part of equity allocation as NYU does not break it out (7) Includes 19.1% l/s equity and 9.6% diversifying strategies, which includes multi-strategy, credit long/short and macro/commodities

related articles: