By Hedge Fund Insight staff

Fitch Ratings has just released its views of the Absolute Return Funds of London-based BlueBay Asset Management – BlueBay Investment Grade Absolute Return Bond Fund (IGARF) and BlueBay Investment Grade Libor Fund (IGL). BlueBay is a specialist credit asset manager with AUM of USD59.1bn at end-March 2015 (USD28.3bn in investment grade credit). BlueBay is now owned by the Royal Bank of Canada.

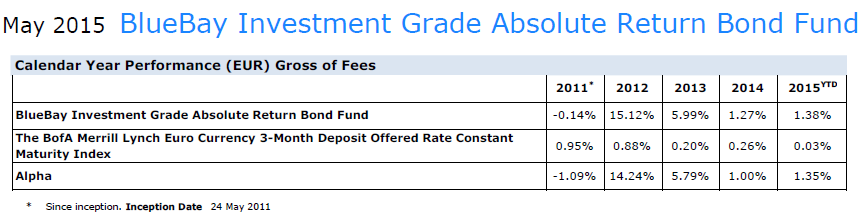

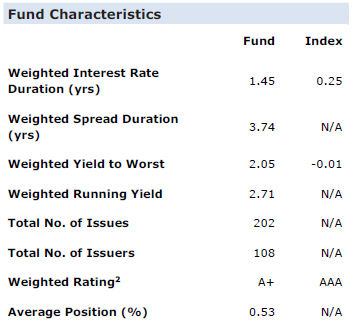

The absolute return funds had USD8.5bn (IGARF) and USD1.2bn (IGL) of assets under management (AUM) respectively at end-May 2015, and IGARF could be considered the flagship product of the firm. BlueBay IGARF and IGL aim to generate excess returns of 300bps and 150 bps per annum, gross of fees, respectively, over the Merrill Lynch Euro Currency Libor 3 Month Constant Maturity Index. BlueBay IGL has interest-rate duration hedged to a maximum of one year. Investors clearly prefer the absolute return fund with wider scope to vary duration and which correspondingly has the higher return target.

The return history of the funds reinforces the investor preferences: since its launch, BlueBay IGARF has achieved its objectives, returning a net annualised 4.2%, with a tracking error of 2.5%, as at end-June 2015. BlueBay IGL has returned a net 3.2% with a 1.9% tracking error but has underperformed most Euro IG funds due to its interest rate duration-hedged strategy.

Fitch comments that “in both funds, credit selection is the main driver of performance, which is consistent with the stated strategy. The funds benefit from markets where there is high disparity in credit returns. However, they tend to suffer when markets are driven by monetary policies and technical factors, as in most of 2014.”

Fitch Analyst Manuel Arrive has affirmed ‘Strong’ Fund Quality Ratings for the BlueBay Investment Grade Absolute Return Bond Funds. The ‘Strong’ ratings reflect BlueBay’s research-driven investment approach, allowing the funds to make the most of global fixed income returns out of diversified sources, according to Arrive. The ratings are also supported by the depth of BlueBay’s investment grade fixed income team – 24 PMs and analysts with an average of 13 years’ industry experience supporting lead portfolio manager Geraud Charpin.

The managers implement a well-balanced research-driven, capital preservation-oriented investment process combining macro, fundamental, technical and relative valuation inputs in a formalised, disciplined manner. But Fitch Ratings also consider the investment process to be flexible and reactive. In terms of portfolio construction BlueBay implements high conviction, mainly relative value trades as the source of returns, albeit within well-defined risk guidelines. On top of this macro exposures are adjusted dynamically using a derivatives-based overlay approach.

There must be some pressure on Geraud Charpin to produce returns in the next year or so. After two flat years net of fees, even if Fitch makes allowances for the macro environment, investors in absolute return funds may not be so patient. The change in Federal Reserve interest rate policy will certainly alter the market environment for absolute return funds – and this BlueBay fund has its largest spread duration position in the US. But will it be a more volatile market environment in which an investment grade bond fund can make absolute returns?