By Hedge Fund Insight staff

It has been a long road back, but Asian hedge funds have at last regained their peak assets – last seen pre-Credit Crunch in 2008. Total assets in Asian hedge funds (excluding Japan) were at $159.8bn at the end of May 2015.

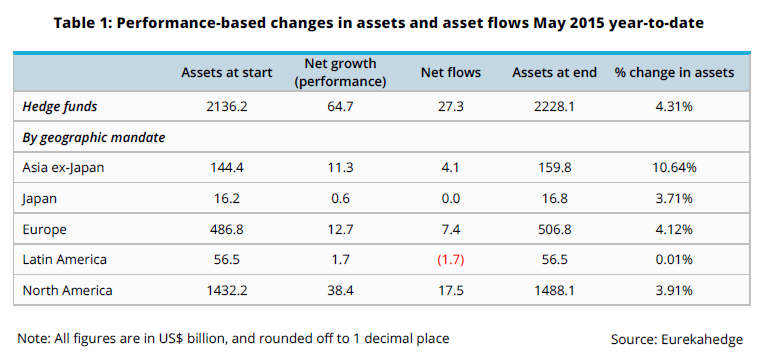

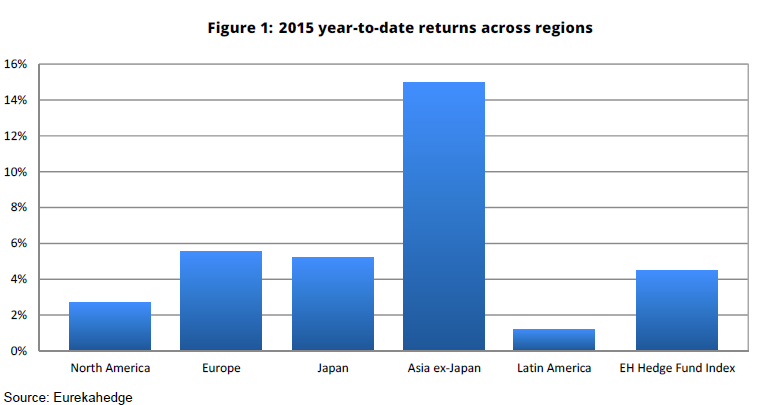

The asset growth since the start of the year has come from both new subscriptions and returns from Asian hedge funds, as Table 1 and Figure 1 show.

It is unusual post-Credit Crunch for Asian hedge funds to attract a disproportionate share of new asset flows to the hedge fund industry. So far this year investors in hedge funds have put to work new capital in hedge funds with an Asian mandate at roughly twice the rate that would equate to the global market share of the region.

You may recall that at the net level American and global focused hedge funds received fresh capital first when investors began allocating again to hedge funds in late 2010. Just over two years later investors in hedge funds subscribed new capital on a net basis to hedge funds investing in European markets. Two years on again, the story of hedge fund flows has taken on a fish sauce and star anise flavour.