From the paper by Diogo Palhares & Scott Richardson: “Looking Under the Hood of Active Credit Managers” (Financial Analysts Journal, 2020)

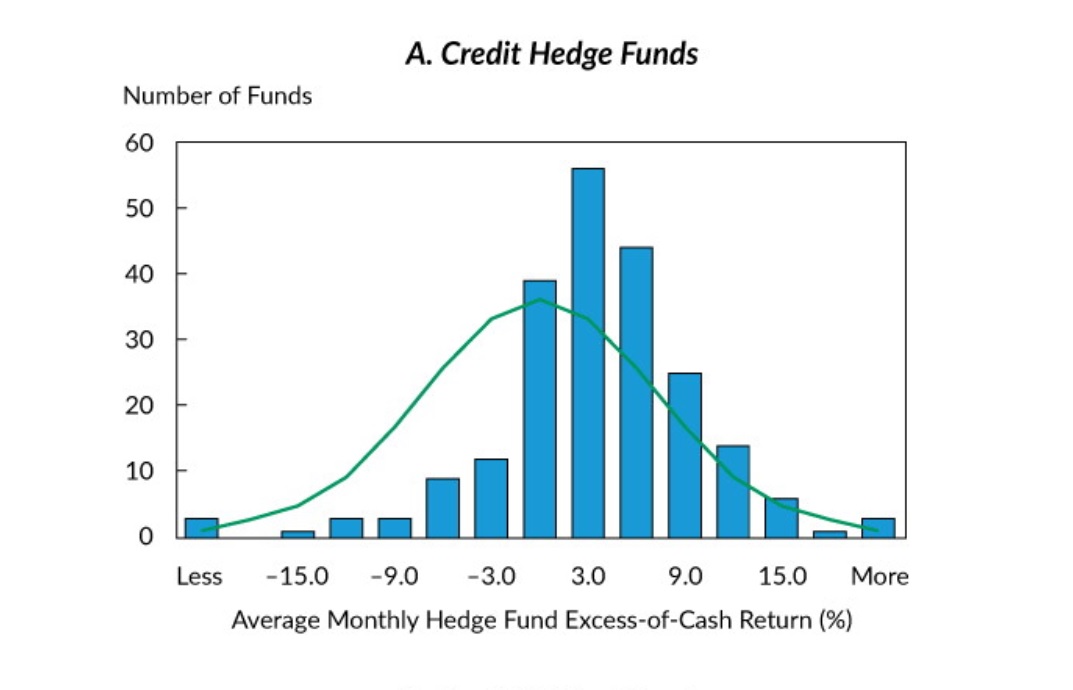

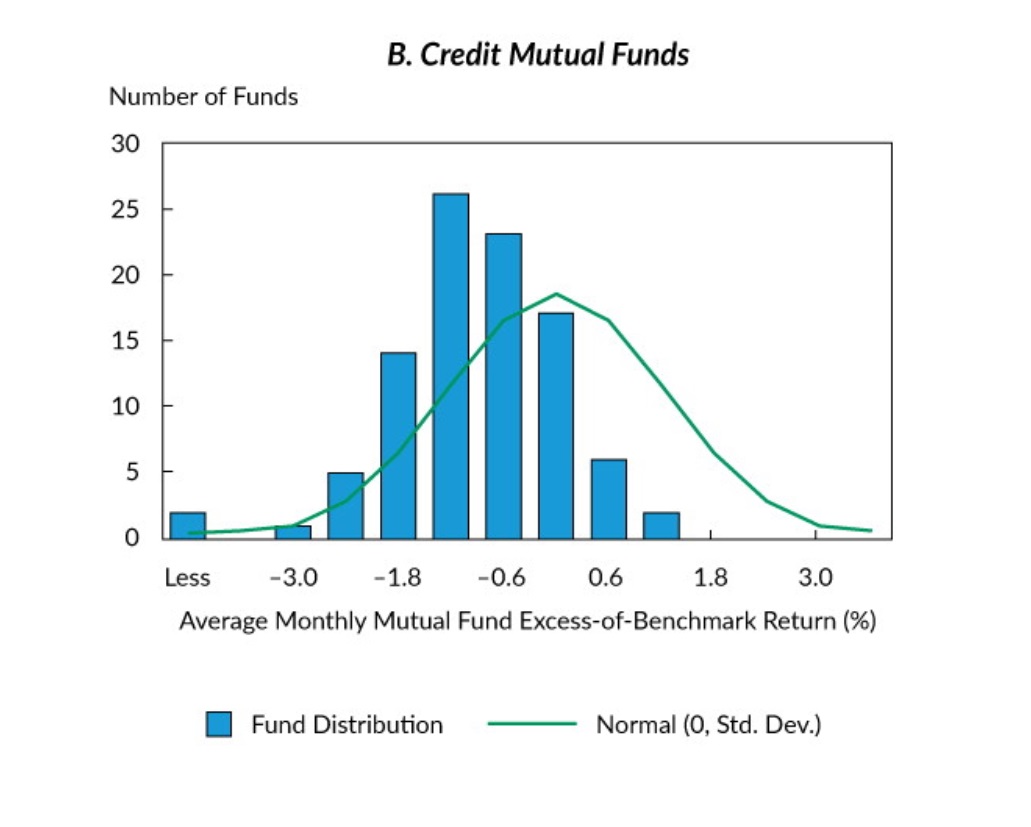

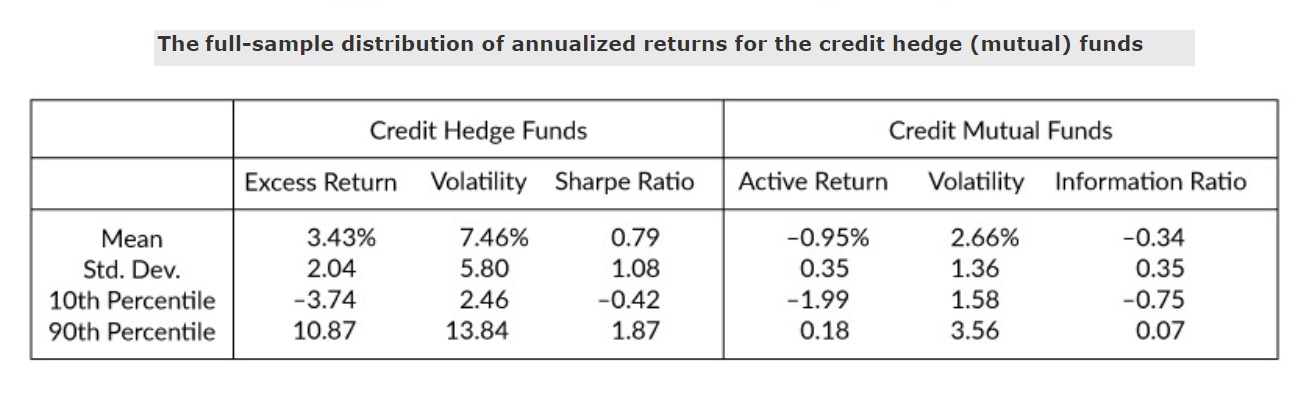

Credit investors beware: actively managed credit hedge funds may provide more beta than expected and mutual funds too little. This paper investigates just how much traditional risk premia is responsible for active credit manager fund returns.

Abstract

Extensive research has explored the style exposures of actively managed equity funds. We conducted an exhaustive set of return-based and holdings-based analyses to understand actively managed credit funds. We found that credit long–short managers tend to have high passive exposure to the credit risk premium. In contrast, we found that long-only managers that focus on high-yield credits provide less exposure to the credit risk premium than do their respective benchmarks. For both credit hedge funds and long-only credit mutual funds, we found that neither has economically meaningful exposures to well-compensated systematic factors.