By Hedge Fund Insight staff

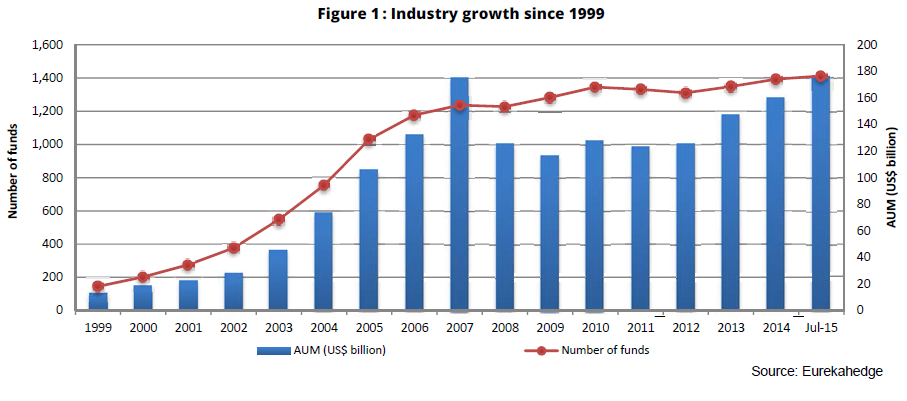

Hedge funds investing in Asia are on a growth trajectory again. The growth of the last few years are an echo of the growth seen pre-Credit Crunch. Of course, as a more mature industry now the rate of growth is lower. There was an explosive growth in the number of Asian hedge funds from the 145 of 1999 to over 1,200 in early 2008. The recent growth of Asian hedge funds is much more in the assets under management rather than in the number of funds – by the middle of this year the number of Asian hedge funds was up a net 200 funds from 2008 to just over 1400 in total. In the last three years assets under management have soared from around $120bn to $177bn (in July this year).

The inference is that existing funds are getting bigger. The data shows that the funds with between $500m and $1bn in assets under management have taken share, and funds over a billion dollars have grown at the same rate as the Asian hedge fund universe. This pattern is different from the hedge funds of North America, wherein (post-Credit Crunch) funds over $5bn have taken most of the growth of the sector until the last year. The biases of investors by size when it comes to allocating new capital have been important in the differential growth rate amongst prime brokers of Asian hedge funds.

The inference is that existing funds are getting bigger. The data shows that the funds with between $500m and $1bn in assets under management have taken share, and funds over a billion dollars have grown at the same rate as the Asian hedge fund universe. This pattern is different from the hedge funds of North America, wherein (post-Credit Crunch) funds over $5bn have taken most of the growth of the sector until the last year. The biases of investors by size when it comes to allocating new capital have been important in the differential growth rate amongst prime brokers of Asian hedge funds.

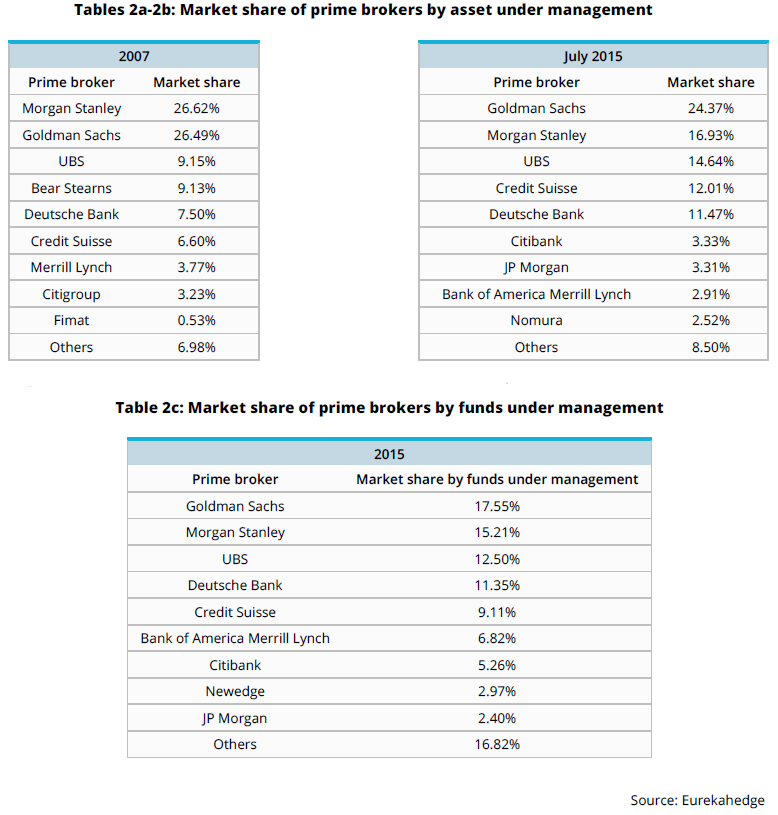

Tables 2a and 2b show that since the Credit Crunch European-owned prime brokerages have been increasingly used by Asian hedge funds. Goldman Sachs has roughly held its market share by the size of assets serviced at over 24%, but the other PB monolithic twin of 2007, Morgan Stanley, has lost share to UBS, Credit Suisse and Deutsche Bank over the last 8 years.

Table 2c shows prime brokerage market share amongst Asian funds by the number of funds. The different share held by Goldman Sachs in Tables 2b and 2c carries the implication that the scions of 200 West Street have a disproportionate share of Asia’s larger hedge funds, through clients such as Morgan Sze’s Azentus Capital. Credit Suisse and UBS also have biases to larger Asian hedge funds in their PB businesses. At least on the part of Goldman Sachs this size bias has been a deliberate commercial strategy, with GS having shed smaller less successful PB clients from each regional PB hub.

The flip side to these biases to the big are that mini-primes and regional specialists have significantly increased their share by number of funds if not assets over the last 8 years. The catchall category “others” together administer assets for some 235 hedge funds (16% of the region’s hedge funds), but those funds manage only 8.5% of the hedge fund assets there.

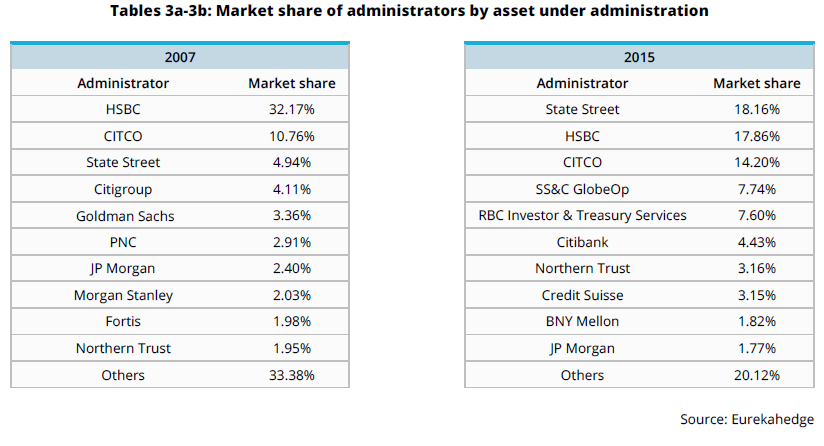

The changes to the distribution of hedge fund administration services in Asia have been much larger than those in prime brokerage. This has been for two reasons – new entrants taking share from a large incumbent, and a long term trend to sector consolidation. Market shares by AUA in 2007 and this year are shown in Table 3.

HSBC once dominated hedge fund administration in Asia with a share roughly the same as the next eight providers put together (Table 3a). Many senior executives running hedge fund administration businesses saw that there were easy market share gains to be taken through takeovers of businesses run by uncommitted owners or by smaller, less-competitive operations. As a consequence the concentration ratios increased everywhere, but particularly in Asia. Only 20% of hedge fund assets are administered by smaller fund administrators in Asia now, compared to a third in 2007.

HSBC once dominated hedge fund administration in Asia with a share roughly the same as the next eight providers put together (Table 3a). Many senior executives running hedge fund administration businesses saw that there were easy market share gains to be taken through takeovers of businesses run by uncommitted owners or by smaller, less-competitive operations. As a consequence the concentration ratios increased everywhere, but particularly in Asia. Only 20% of hedge fund assets are administered by smaller fund administrators in Asia now, compared to a third in 2007.

A driver in these deals was often the increasing development cost of systems. Spreading an absolute Dollar cost over a larger client base made sense in a period when fund administrators in the hedge fund area competed on what their systems could do for clients.

The most prominent takeover was done by State Street in 2012 when it bought Goldman’s Hedge Fund Administration Unit, making it the largest administrator of hedge fund assets in the world. Asia was a case in point, and State Street is now the largest administrator in Asia, closely followed in size by regional powerhouse HSBC.

Takeovers also helped other fund administrators into the Top 10 in Asia. SS&C has grown its administration business by takeovers, particularly the transformational purchase of GlobeOp in 2012. The Royal Bank of Canada’s fund administration business took over Dexia Investor Services and now ranks as the fifth largest provider. The name BNY Mellon came into the Top 10 amongst Asian fund administrators when it bought the administration business of PNC , PNC Global Investment Servicing.

The fund administrators that have tenure from 2007 to 2015 in the Top 10 are CITCO, which has significantly increased share over that period (10.76 to 14.2%), and Citi and JP Morgan. Credit Suisse and Northern Trust complete the current Top 10 with shares of 3.15% and 3.16% respectively by AUA.