By Ariel Markelevich, Ph.D., CMA, and Leena Roselli for Financial Executives Research Foundation, Inc.

Based on recently published financial information, Merger and Acquisition (M&A) activity has been on the rise since 2009 with 2013 activity volume valued at $2.9 trillion-the highest since 2008’s $3.1 trillion mark.1 This upward trend has continued into the first quarter of 2014. Global M&A reached $804.5 billion, which is up from the prior year by 23 percent.2

Although deal value was up, the deal volume was down by 15 percent, the lowest since 2005 which means that the cost of deals has risen and there is more cash to invest, in contrast to prior years.

“The price of the good deals has increased, therefore driving up multiples,” states Tim Gosline, Partner at Riverside Company,“….there are many people on the sidelines with cash willing to invest.”

There are many reasons M&A activity is expected to increase in the coming years including large cash reserves, opportunities in emerging markets, availability of credit on favorable terms, and improved consumer confidence. Furthermore, according to a study conducted by KPMG in its 2014 M&A Outlook Survey Report,36 percent of 1,000 professionals surveyed indicated that they will initiate one, if not two, deals this year.

As the M&A environment is improving, it is important for both buyers and sellers to be prepared by being aware of challenges, especially during the critical transaction phase of an M&A deal. In a collaborative research project between Financial Executives Research Foundation (FERF) and Merrill DataSite® this extract from the Report “M&A Challenges In the Transaction Phase” explores the challenges that senior-level financial executives and industry experts face, from a buyers perspective, experience during the transaction phase of M&A.

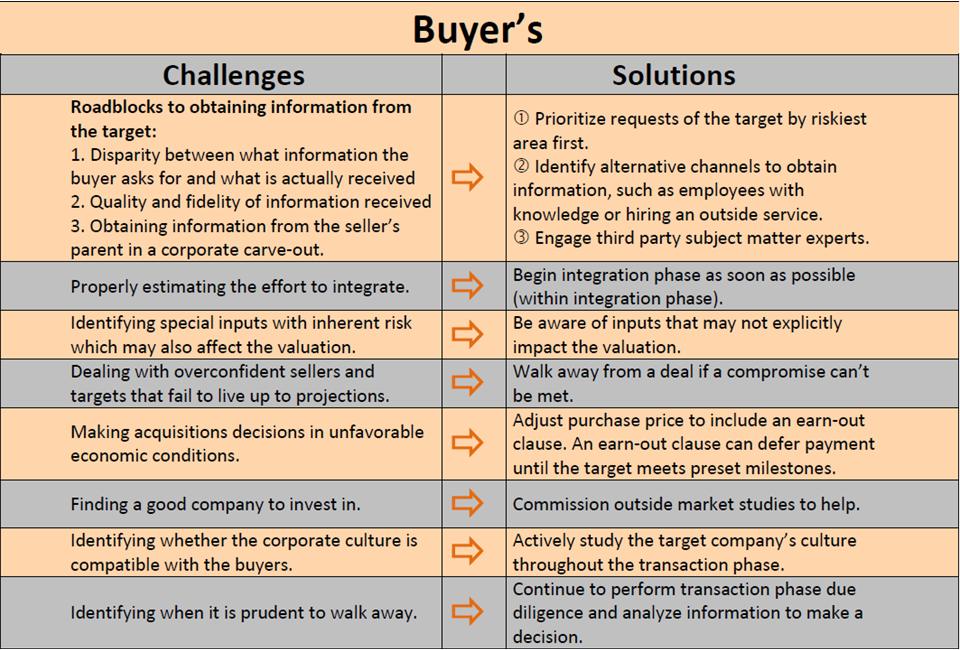

The chart below summarizes buyers’ sellers’ challenges and, in most cases, provides solutions in a deal’s transaction phase.

source: Financial Executives Research Foundation, Inc. (FERF)

source: Financial Executives Research Foundation, Inc. (FERF)

BUYER’S CHALLENGES AND SOLUTIONS

Roadblocks to Information

The most frequent challenge buyers experience during the transaction phase is receiving information from a seller. Several roadblocks identified are: Disparity between what information buyers have asked for and what is actually received; quality and fidelity of information received; and obtaining information from seller’s parent in a corporate carve-out.

Solutions provided include: prioritize the requests of the target by riskiest area first, identify alternative channels to obtain information, such as employees with knowledge or hiring an outside service, and to seek third party experts.

Joe Whittinghill, Managing Director, M&A Venture Integration Group at Microsoft explains that when dealing with small companies, the information required to make critical decisions is often difficult to obtain. Often times, the information is not available in a format or convention similar to the working documents they use internally. Additionally, the target doesn’t always share information since both sides are still negotiating and contending for

the best possible deal. For example, information tightly linked to detailed forecasts is rarely ever shared during the transaction phase.

Another challenge Whittinghill shares about informational roadblocks is receiving accurate information. Whittinghill says that he is always concerned with the “quality and fidelity of the information provided.” For instance, in international acquisitions, Microsoft is faced with the extra effort of translating financial statements from International Financial Reporting Standards (IFRS) back to U.S. GAAP to better understand the quality of earnings

of the target. The solution is to engage third party consultants to provide easier analysis of the figures.

The M&A Accounting Controller at a large technology company confirms information roadblocks as their number one challenge as well. The controller explains that since most targets are smaller companies, a disparity usually exists between requesting and receiving information from a considerably larger buyer. Additionally, smaller targets don’t have the appropriate amount of experienced top-level management to fulfill transaction due diligence phase type requests. He states, “The sellers are also reluctant to hire outside services (tax, legal, finance, etc.) or invest in appropriate infrastructure because they aren’t guaranteed a sale will transpire.”

Also, due to the size disparity between the buyer and seller, the controller states, “There are approximately two dozen acquisition team members from the acquiring company’s side who are requesting information from one to three owners or key employees at the target’s side. This eventually leads the target company to be overwhelmed with information requests.”

As a solution, the controller suggests, “The acquiring company should prioritize their requests of information by degree of risk areas; i.e., focusing on the riskiest areas first and gradually to the less risky information.”

The controller admits there are gaps between information actually received versus the amount of information that is necessary to make an informed decision. This may lead the company to make the wrong decision in some cases.

The controller adds that another informational roadblock is accessing information from the appropriate employees; i.e., “employees that are in the know.” Contact with the target organization is only made with limited key employees who, often times have the most to benefit from the sale of the organization. Furthermore, discreetly obtaining real world information using other venues such as contacting key employees who will be acquired in the transaction or customers brings about another challenge.

The solution would be “to find employees with working knowledge of the company who are not directly influenced by the sale and/or hire outside services to help with data compilation using undercover methods to ensure confidentiality of the prospective acquisition.”

Named Example 1. Kenneth Hall, Vice President and Controller at Home Properties, notes that informational roadblocks also topped his list of challenges. His biggest roadblock is obtaining accurate information in a recognizable format. He explains, “We are confronted with translating the target’s financial statements into U.S. GAAP. In most cases, the real estate target would maintain financial statements on a tax reporting basis and not external or SEC reporting purposes. Therefore, it would be necessary to capture the appropriate assets that need to be capitalized, as well as, establish accruals such as payroll to make financials compliant with U.S. GAAP.”

In addition to solutions mentioned above, Mr. Hall is forced to make a lot of assumptions.

Additionally, Hall provided audited financial statements of the acquired properties to comply with SEC’s requirement3,. The requirement was necessary when the total amount of the aggregated immaterial purchases is over 10 percent of the purchaser’s total assets.

To ensure that the sellers supported the company with the SEC requirements even after the acquisition was finalized, he explains, “The solution is to make sure that the purchase agreement with the seller contained a clause that they will need to cooperate with the need to provide the audited financial statements to the SEC.”

Hall’s final roadblock to information was working with the target’s information technology systems. Even though this will not be a deterrent from purchasing the property, the platform that is used is considered during the transaction phase. He explains, “If compatible, it is easier to bolt on to our platform; however, if the target has a different

system or has no system, the company will need to key in the information manually postsign.”

The solution would be to have trained staff manually input the information into Home Properties database.

Names Example 2. Tom Gosline, Partner at The Riverside Company, also concurs that his biggest challenge was

informational roadblocks. Gosline discusses this challenge from a corporate carve-out of a multi-billion dollar corporation perspective. He shares that understanding the true stand-alone cost of health benefits and business insurance that were previously funded by the parent are some of the issues that are critical to get right. He explains, “Normally, when you carve a smaller piece out of a larger organization, you cannot get the same cost structure

for insurance as a large parent corporation can obtain; therefore, we had to go through extra work to understand the true costs of medical, pension liabilities and business insurance on a standalone basis that the company would be responsible for post close.”

The solution was, in part, to hire outside consultants to help with the calculation. After transition, the company converted the benefit plans from defined benefits to defined contributions.

Properly estimating the effort to integrate

During the transaction phase, it’s necessary to begin integration planning. This will not only identify the necessary particulars of the firm being acquired, but also allows the buyer to identify whether it has the capacity and capability to integrate the target.

Microsoft’s Whittinghill advises “…don’t underestimate the need to initiate the integration process started as soon as possible…this will inform the deal model and final decisions that you’ll make about the transaction. As you start the integration planning during the transaction phase or as soon as possible, you begin to understand the strength and

weaknesses of the talent you are buying…whether it be the talent, processes, products, customer base or reputation in the market, you begin to understand the complexity of operating it…and in some instance, the acquirer may determine that the target is just too complicated to operate…”

Identifying and assessing valuation risks

Beyond the required inputs used in the valuation, the challenge is to identify special inputs with inherent risk which may also affect the valuation. A few examples of special inputs include: additions to discount rates for uncertainty and risk where there is no comparable marketplace for private companies; risks of foreign companies including translation of foreign currencies; differences in regulations and taxes; political risk; and complete control factors.

Microsoft’s Whittinghill shares that determining and assessing the risk profile and all other risks associated with the purchase and integration is another challenge he experiences with acquisitions and how these risks will translate to valuation adjustments. He explains, “As companies engage in the process of confirmatory due diligence, these risks become more apparent and you may want to change what you pay for these assets depending on what you learn.” He continues, “During this due diligence phase, the assessment of risk may cause the valuation to drop or changes to another consideration made from the letter of intent originally signed.”

Therefore, the solution is for buyers to be aware of items that may not explicitly impact the valuation and think outside of standard inputs.

Overconfident sellers

Often times, there may be a disconnect between business sellers’ ‘high’ expectations and buyers’ ‘conservative’ bids. This is caused by either the targets falling short of expectations within the diligence phase and/or the seller not placing a realistic valuation on their business, adding to an unwillingness to capitulate on a price to close the deal. This disconnect may result in the deal not closing as the buyer loses confidence in the target or is unwilling to negotiate with the seller.

Ray Newman, Managing Director at Duff and Phelps, indicates that the biggest challenge he experienced on the acquiring side is that the target’s performance throughout the transaction phase not living up to the expectations/projections provided in the Confidential Information Memorandum (CIM). This is a challenge for both buyers, as they have invested time in the company/target’s; and sellers who, perhaps, are not balancing the due diligence phase and maintaining the value of their company (discussed below.) In most cases, this revenue shortfall may lead to a decrease in earnings before interest, taxes, depreciation and amortization (EBITDA) which, in turn, may translate into a lower valuation and lower purchase price.

The solution may be to walk away from the deal if a compromise cannot be met on value.

Newman also has experienced sellers that set high expectations for their company. He explains, “When selecting an advisor, most times the seller may go for one that promises to get the highest price. But this price is normally set without looking under the hood; therefore, the seller may have an unrealistic expectation.”

Make acquisition decision in economic downturn or unfavorable economic conditions

It is fair to conclude that an economic downturn or unfavorable market conditions provide abundant opportunities but at the same time contain equally the amount of risk.

The Riverside Company’s Gosline explains that one of the bigger challenges in making the decision of when and into what to invest in is the threat of an economic downturn or unfavorable conditions (or terms).

As a solution, The Riverside Company may adjust their purchase price to include an “earnout” clause in the agreement. An earn-out is a risk‐allocation mechanism used in an M&A transaction whereby a portion of the purchase price is deferred and is calculated based on the performance of the acquired business over a specified time period following the closing. By including this clause, Riverside can mitigate risk of loss and maintain the purchase multiple in the valuation.

Finding a good company

The dollar volume of M&A deals are up and volume is down. It appears buyers are paying more for deals than before.

Gosline explains, “The challenge in today’s environment is finding good companies to invest in, for the right price. There is also a lot of money on the sideline chasing a few good deals and this is driving up the purchase in multiples for the good companies…when you “pay up” for these companies you better be sure of their future growth rate.”

As a solution and when appropriate, the firm commissions outside market studies to help with the calculation. “This, unfortunately, leads us to spend more money to find a deal,” he explains.

Identifying corporate culture compatibility

Culture can be difficult to define. It is the “knowing it when you see it.” Identifying whether the culture is compatible is a buyer’s challenge in the transaction phase. A majority of mergers have been unsuccessful because of incompatible cultures.

Microsoft’s Whittinghill emphasizes the importance of understanding and evaluating the corporate culture of the target. He explains that an acquirer should “never underestimate the importance of culture.” He suggests the acquirer should ask the question, “Will their corporate culture match up with ours and will there be a synergy between the two?”

As a solution, he suggests to actively study the target company’s culture throughout the transaction phase and even before. He explains, ”As most know, many large mergers have failed because of culture.”

When to “walk away” from a deal

Making a deal is the final goal, and there is a lot of money and time incurred by large teams to get to the final goal. An article from the Harvard Business School states “…the fact is, the momentum of the transaction is hard to resist once senior management has the target in its sights. Due diligence, all too often, becomes an exercise in verifying the target’s financial statements rather than conducting a fair analysis of the deal’s strategic logic and the acquirer’s ability to realize value from it. Seldom does the process lead managers to kill potential acquisitions, even when the deals are deeply flawed.”

Whittinghill of Microsoft states that the final challenge of a seller is making an informed decision of when to abandon the deal. He explains, “At this point, i.e., the due diligence phase, a buyer may get ‘buyer fever’ and continue to go through with the deal even though it is a bad deal versus having the confidence to walk away from the transaction given what you have learned. Once you move into confirmatory due diligence, you get 100 percent smarter about the acquisition you are making; as information gets richer, the fidelity of your valuation models go up; thereby, making the go or no go decision easier.”

© Financial Executives Research Foundation, Inc. (FERF) www.ferf.org

For a free copy of the full report, go to:

http://www.datasitedeal.com/ChallengeSolution?LeadSource=FEI&CampaignID=701C0000000ig6P

(registration required)

1Dealogic Global M&A Review – Full Year 2013,

http://www.dealogic.com/media/market-insights/ January 2, 2014.

2Dealogic Global M&A Review – First Quarter 2014, http://www.dealogic.com/media/96683/dealogic_global_m_a_review_-_1q_2014.pdf

3 S-X, Rule 3-14

One Response to “The Buyers’ Lot in Mergers & Acquisitions”

Read below or add a comment...