By Mark Rzepczynski, CEO at AMPHI Research and Trading, LLC

The behavioral finance revolution has added immensely to our knowledge on the aberrations from efficient markets and rational expectations. Mistakes happen because we are sloppy thinkers. However, the wide list of behavioral biases does not help us define what it means to be rational in real life situations or how we learn to be rational under different circumstances. Solving for rational decision-making is a difficult problem. My view is that the first choice is to use quantitative tools given that the investment world is rich with data, yet there have been some interesting attempts at finding broader solutions to incorporate other thinking.

An interesting framework for how to look at problems is referred to as ecological rationality. The tools to be used for a given decision should be related to the environment faced. Determining what to do if you are a fireman at a burning building should be different than if you are analyzing the cheapness of a mortgage. Similarly, analyzing the potential success of a new business strategy is different than looking at the trade-off between stocks and bonds.

There are a number of key researchers in this important area, including Gerd Gigerenzer and his team at the Max Planck Institute for Human Development and the naturalistic decision-making expert, Gary Klein. For them, context is important. They try to solve the puzzles that have been aptly researched by Daniel Kahneman, the Noble Prize winner. Data rich problems lend themselves to quantitative analysis; however, new uncertain problem may need other approaches.

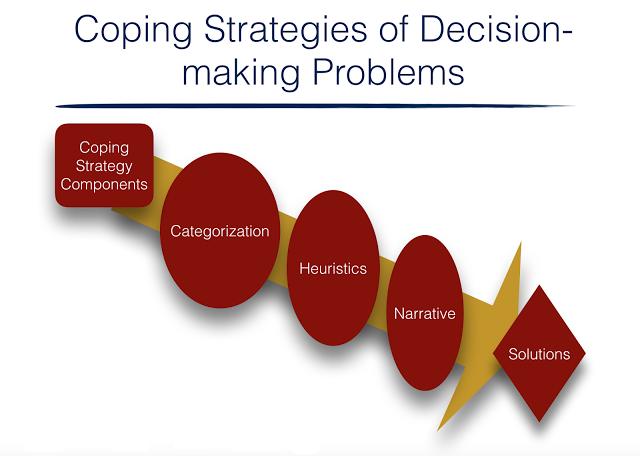

To simplify much of this work, the focus has to be on basic coping strategies for any decision process. This coping can be broken into three parts: categorization, heuristics, and narrative.

The primary strategy issue is categorizing the problem. In the case of uncertainty, is the problem an issue of a lack of information, unreliable information, or an inadequate understanding of the available information? For investment issues, the most likely problem is inadequate understanding and not a lack of information.

The second strategic issue is determining what type of model or heuristic to be used. In a Kahneman world, does this require fast or slow thinking? Does the problem lend itself to a quant tool or does it require different thinking?

The third issue is forming the correct narrative. Decision narratives are critical for managing and understanding actions taken. How should the problem be framed? What is the expected answer? How do you assess whether the process was successful?

Good decision-making requires discipline even if the problem is not well-defined or ambiguous. Good solutions are important, but the process is more critical for success.

This article was published on the IASG blog: http://blog.iasg.com/